Philippine stocks have rapidly gone from one of the world’s best performers to the absolute worst, prompting the nation’s growing pack of retail investors to shift attention to speculative penny stocks in the search for better returns.

Retail Traders in World’s Worst Market Snap Up Speculative Plays

Philippine stocks have rapidly gone from one of the world’s best performers to the absolute worst, prompting the nation’s growing pack of retail investors to shift attention to speculative penny stocks in the search for better returns.

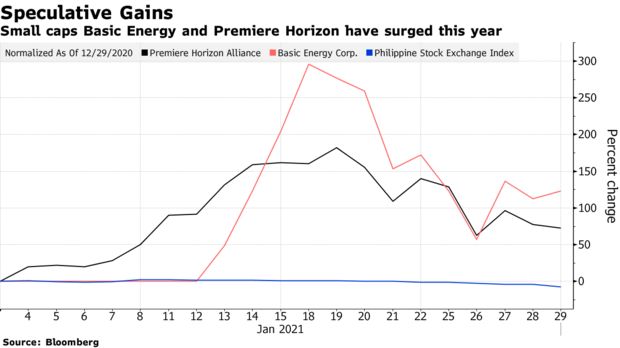

The Philippine Stock Exchange Index is down 7.4% so far this year, the biggest decline among 92 global equity benchmarks tracked by Bloomberg. That’s a dramatic turnaround after the gauge’s 22% surge in the three months ended December saw it ranked No. 16 for that period.

Faced with a decline in the nation’s biggest stocks amid an exodus of foreign investors and a weak economy, local individual traders are shifting to riskier plays, mirroring their global peers. U.S. retail investors have been piling cash into small caps, initial public offerings and options as the S&P 500 Index has treaded water so far in 2021.

Riskier the Better Is Rallying Cry of Day Traders Going Small

Philippine small investors are fueling a surge in speculative stocks, flush with funds from last quarter and enabled by the growing power of internet trading platforms, according to Conrado Bate, president of COL Financial Group Inc., the nation’s biggest online stock broker.

Such trading strategies have led to some major volatility. Daily single-stock gains of at least 30% have been recorded 33 times in January, the most for any month since November 2011, according to data compiled by Bloomberg. Basic Energy Corp., a microcap oil explorer, accounts for five of those moves, with its shares more than doubling so far this year.

“We are seeing the rise of mass retail online investors,” said Bate, adding that 80% of COL’s new clients buy speculative stocks for a “quick buck.”

As in many markets around the world, low interest rates and the pandemic lockdown provided a big push for retail investing in the Philippines. COL’s number of new clients more than doubled in 2020.

Risk Reward

Eleazar del Rosario, a 33-year-old part-time university lecturer, said he started investing in 2015 but only became active in March after taking a three-month tutorial in day trading. Working toward achieving “financial freedom,” his trades include speculative stocks that while fraught with risks “are really the big movers,” unlike blue chips.

Del Rosario said he doesn’t own stocks for long, often changing his holdings weekly or even daily.

Gains for tiny stocks are hit-or-miss, though the MSCI Philippines Small Cap Index is down 4.2% in 2021, outperforming the 7.9% loss in the index provider’s broader gauge for the country. Still, recent successes like Basic Energy and Premiere Horizon Alliance Corp. — a developer and miner whose shares have surged 73% to a market valuation of about $90 million — are making speculative trades too tempting to abandon.

“Addicted to their sharp gains from previous trades, many are looking for the next big one,” said Kevin Khoe, a former equities analyst who has been trading stocks since 1994. “We see more speculative plays happening simultaneously now because online trading is faster and it has created a wider investor base.”-Bloomberg

The Star, 01 February 2021 (Monday)

News Articles

McM Articles

Events

Financial Crisis Reports

2025-01 McM crisis report 01

2024-12 McM crisis report 12

2024-11 McM crisis report 11

2024-10 McM crisis report 10

2024-09 McM crisis report 09

2024-08 McM crisis report 08

2024-07 McM crisis report 07

2024-06 McM crisis report 06

2024-05 McM crisis report 05

2024-04 McM crisis report 04

2024-03 McM crisis report 03

2024-02 McM crisis report 02

2024-01 McM crisis report 01

- Archives -